Health insurance can be challenging to navigate, mainly when unexpected changes occur. That’s where short term health insurance comes in, providing a flexible safety net when needed most, whether you are between jobs, outside of enrollment periods, or simply seeking temporary coverage. Understanding short term health plans is essential for affordable protection. Let’s explore their uniqueness and how they fit into your healthcare strategy.

What is short term health insurance?

Short term health insurance offers temporary medical coverage when you’re between health plans, outside of enrollment periods, or need emergency protection. To make the most of it, you should understand how these plans work, their costs, and what they cover. These temporary plans can vary significantly from traditional health insurance in many ways.

What is covered by short term health insurance?

The coverage provided by short term health insurance can differ significantly based on the specific plan and the insurer. Unlike ACA (Affordable Care Act) plans, these short term plans are not obligated to follow ACA guidelines. While ACA plans must offer a minimum essential coverage,short term health plans are not held to these exact requirements.

short term medical insurance usually offers some coverage for preventive care, doctor visits, urgent care, and emergency services. It might also include prescription coverage and cost savings when you visit in-network providers. Review the “exclusions and limitations” section before purchasing any plan, as it details what is and isn’t covered.

How much is short term health insurance?

If you’re thinking about temporary health insurance, here are some expected upfront costs to consider:

- Premium: This is the monthly payment for your coverage. The amount depends on your coverage level, including the deductible, coinsurance, and services covered.

- Coinsurance is the percentage of out-of-pocket costs after you’ve met your deductible. It is usually expressed as a percentage. Most short term plans include both a deductible and coinsurance.

- Deductible: Short term health plans typically have higher deductibles compared to traditional plans. It would be best to cover the cost of services up to this amount before your plan starts sharing the expenses.

- Copay: This is a fixed fee you might need to pay when visiting a doctor, usually at the time of the visit. Some short term plans require copayments for certain doctor visits.

- Other out-of-pocket costs: If your short term plan doesn’t cover certain healthcare services, you’ll be responsible for paying the full cost. For instance, some short term plans might not cover or limit coverage for maternity care, mental health services, substance use treatment, vision care, or dental care—meaning you’ll have to cover these expenses yourself.

Depending on your coverage, there could be additional costs, so it’s essential to read all the plan details carefully to understand what your plan might cost you.

How long does short term health insurance last?

Short term life insurance is a temporary coverage plan that typically lasts up to a year. While it might not be suitable for everyone, there are specific situations where opting for short term life insurance can be a smart financial move. Understanding these scenarios can help you decide if this type of coverage fits your needs.

Before 2018, federal regulations restricted short term health plans to less than a year. However, the Trump administration removed these limits, allowing consumers to purchase short term plans for up to a year and renew them for up to three years.

The availability of short term plans varies by state. In California, short term plans are banned, and other states with strict regulations, such as Massachusetts, New Jersey, and Rhode Island, also have limited or no options for these plans. To learn about your state’s laws, visit the Center on Budget and Policy Priorities website.

Pros and cons of short term health insurance?

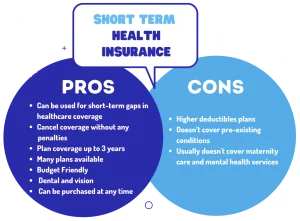

If you are considering short term health insurance, here are some pros and cons to think about:

Pros of short term health insurance

- Fills Short Term Coverage Gaps: Offers temporary protection when you need insurance coverage for a short period.

- No penalties for cancellation: You can cancel your coverage at any time without facing penalties.

- Flexible Coverage Duration: If needed, you can choose a plan that provides coverage for up to a year.

- Variety of plan designs: A wide range of plans are available, depending on the insurance provider

Cons of short term health insurance

- Higher deductibles: Deductibles are generally much higher than those in traditional health plans, with potential additional unexpected costs.

- Limited coverage: These plans do not cover pre-existing conditions and offer limited coverage for many services.

- Medical questionnaire: Approval for coverage may require completing a medical questionnaire.

- Lack of standardization: Coverage varies widely between plans, with minimal government regulation and oversight.

Short term health plans are only suitable for some. For comprehensive coverage and benefits, enrolling in a traditional health plan through your employer, an individual insurance company, or the Health Insurance Marketplace is better.

Short term health plans vs. ACA health plans

Short term plans were designed to bridge temporary coverage gaps that may arise in specific situations. However, they are usually not ideal replacements for traditional health plans. These plans are optional to follow ACA standards, offer limited benefits, and often come with significantly higher costs.

In contrast, the government requires ACA health plans to provide specific types of coverage. They must include essential health benefits such as maternity and preventive care at 100% and mental health and substance use services. Before opting for a short term health plan, thoroughly understand what care and services are covered and what are not. Carefully examine the exclusions and limitations listed in the plan details.

Do short term health insurance plans cover pre-existing conditions?

Short term health plans are not governed by the Affordable Care Act (ACA), so they are not required to meet those standards. This means pre-existing conditions are not covered under a short term or temporary health plan, and you could be denied coverage for any medical condition you’ve previously received treatment for.

Is short term health insurance a good idea?

Short term health insurance might not be suitable for long-term use. Still, there are certain situations where temporary coverage can be helpful, such as:

- You missed the open enrollment period for a traditional health plan.

- You lost your job or left your employer.

- You turned 26 and are no longer covered under your parent’s health plan.

Is a short term health plan right for you? Start by assessing your future health needs. Would a short term plan save you money compared to going without insurance? Take the time to explore the plans available to you, as duration, benefits, and costs can differ significantly between insurance providers. Additionally, plan options may vary depending on your state’s regulations.

How can you purchase a short term health insurance plan?

Short term health plans are available through private insurance companies. Still, not all companies offer them (for example, Cigna HealthcareSM does not). These plans aren’t available through the Health Insurance Marketplace and don’t follow Affordable Care Act (ACA) guidelines. Suppose you’re interested in purchasing a short term medical plan. In that case, you’ll need to search for a private insurer that provides them. Be sure to carefully read all the details before buying or enrolling, as these plans vary widely in cost and coverage.

FAQs

How does short term health insurance work?

Short term health insurance offers temporary coverage, usually ranging from a few months to up to a year. It provides basic health benefits and is often cheaper than regular health insurance. However, it may not cover all services, like pre-existing conditions, and may have higher out-of-pocket costs. You can apply at any time, and coverage can start quickly.

Here’s a summary of how it works:

- Coverage Duration: Short term plans usually last from a few months to a year. They are designed for temporary use and usually have specific duration limits.

- Benefits: They typically offer basic coverage for essential health services but may only cover some things, such as pre-existing conditions or certain types of care.

- Cost: Premiums are generally lower than those for standard health insurance plans. However, out-of-pocket costs like deductibles and copayments may be higher, and the coverage may be more limited.

- Enrollment: You can apply for short term health insurance anytime, and coverage can usually start quickly.

- Limitations: These plans are optional to comply with all the Affordable Care Act (ACA) requirements, so they may not cover essential health benefits or provide comprehensive protection.

Overall, short term health insurance can be a helpful option for temporary gaps in coverage but may not be suitable for long-term health needs.

Limitations of Short Term Health Insurance

Short term temporary health plans come with several restrictions:

- Limited Coverage: These plans usually offer less comprehensive coverage than regular health insurance. They may not include essential benefits like maternity care or mental health services.

- Pre-existing Conditions: They generally do not cover pre-existing conditions, which means any health issues you had before starting the plan won’t be covered.

- Narrow Provider Networks: Short term plans often have limited networks of doctors and hospitals. If you need to see providers outside the network, this can lead to higher out-of-pocket costs.

- Short Duration: These plans are meant for temporary use and have a limited coverage period, usually from a few months to up to three years.

- Medical Underwriting: Enrollment usually involves answering medical questions and meeting specific health requirements, which can affect your eligibility and cost.

It’s essential to weigh these factors and ensure the plan aligns with your needs before purchasing.

What health insurance covers Wegovy?

The coverage for Wegovy depends on your health insurance plan. To find out if Wegovy is covered, contact your insurance provider (like Kaiser, Aetna, Anthem, or Blue Cross Blue Shield) and ask about their requirements. If Wegovy isn’t covered, you might explore other options, such as financial assistance from the drug manufacturer or discount programs.

Even if your insurance does cover Wegovy, you might still have to pay part of the cost, like a copay or coinsurance. Check your insurance plan’s details to understand any out-of-pocket expenses.

What is the difference between short term and long-term insurance?

- Long term insurance covers life and people, and its policies last several years.

- Short term insurance covers objects and possessions, with policies lasting a few months to up to three years.

- Long term disability insurance supports those unable to work for an extended period or permanently, while short term disability insurance is for temporary injuries with a return to work expected.

- Short term health insurance requires more frequent renewal due to its shorter coverage period, whereas long term health insurance can provide coverage for two to three years.

Can I get short term health insurance for my family?

Yes, spouses and dependents can be included in a short term health insurance plan. However, since these plans are medically underwritten, all family members must answer medical questions and meet the plan’s health requirements.

Final Words

Short term health insurance provides temporary coverage for individuals who do not have regular health insurance. These plans usually offer less coverage and come with many restrictions. They typically don’t cover pre-existing conditions and may have limited provider networks, which could mean higher out-of-pocket costs. It’s important to carefully review your options to make sure the plan suits your needs and budget before purchasing.

Leave a Reply